The Stable Path: Navigating Stablecoin Adoption in Nigeria

Exploring Stablecoin Adoption in Nigeria: Opportunities, Challenges, Regulatory Landscape, nd Case Studies Around The World.

Table of Content

Introduction

Currency volatility has plagued Nigeria for decades, eroding incomes and savings for millions of citizens. The naira recently plummeted to a record low against the US dollar as inflation neared 30%. This currency crisis exacerbates an already dire economic situation.

Also, in 2016, the Naira crashed over 30% against the US dollar as global oil prices plummeted, severely impacting the economy and people's livelihoods. Such currency fluctuations create business uncertainties and disrupt trade. This is where stablecoins come in.

Stablecoins are cryptocurrencies designed to have a stable value relative to a fiat currency or other benchmark. They achieve this through various mechanisms, such as fiat collateralization or algorithmic supply adjustments.

As Nigerians grapple with currency volatility, capital controls, and limited access to traditional banking services, stablecoins offer a compelling alternative. Their steady value could bring much-needed stability to everyday commerce. But this promise is not without significant obstacles. Can stablecoins deliver economic empowerment to the masses? Or will regulatory uncertainty and infrastructural challenges prevent wider adoption?

This article will explore the world of stablecoins in Nigeria. It will analyze use cases driving adoption and examine user and business challenges. It will also argue that while stablecoins present a compelling use case in Nigeria, substantial challenges around regulation, infrastructure, and public trust must be addressed to drive widespread adoption.

By exploring the landscape of stablecoins in Nigeria, their benefits, and nations, this essay aims to spur constructive dialogue on how this technology can strengthen Nigeria's financial ecosystem.

Understanding Stablecoins

Stablecoins are a specific type of cryptocurrency designed to have a stable value relative to an external reference like the U.S. dollar, gold (Top 10 stablecoins backed by gold), or other cryptocurrencies. Unlike regular cryptocurrencies like Bitcoin, Ethereum, and Solana, which can fluctuate wildly in price, stablecoins aim to maintain a steady pegged value over time.

The critical characteristic that distinguishes stablecoins from other cryptocurrencies is their stabilized value. They serve as a bridge between traditional finance and the world of cryptocurrencies. Their stable value allows them to function as a store of value and medium of exchange, much like fiat currencies.

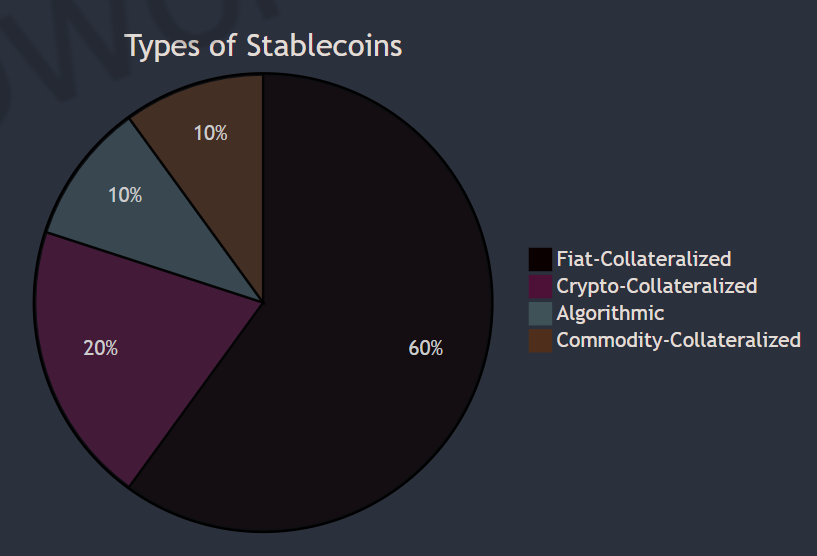

There are four main types of stablecoin designs. Their difference is in their models for maintaining a stable value.

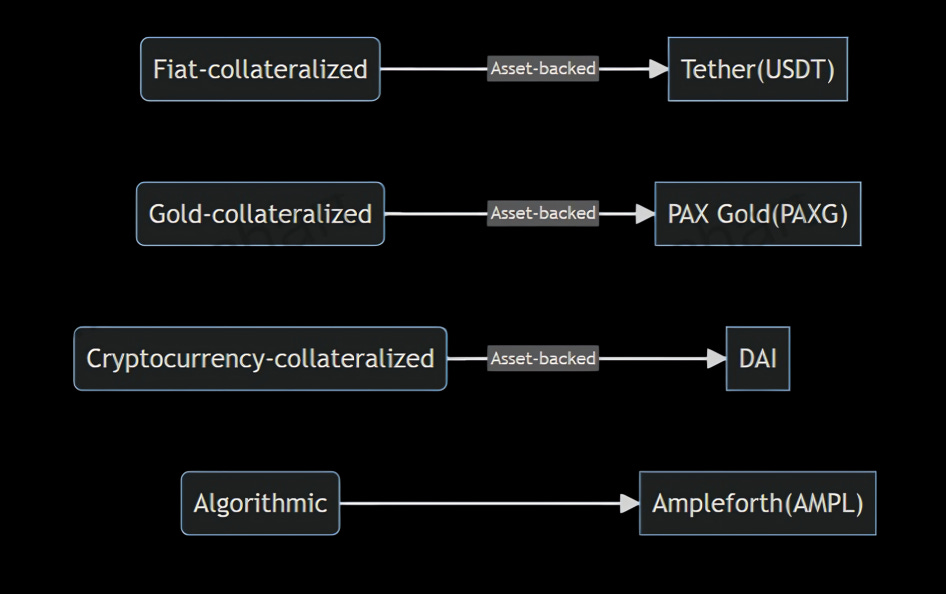

a. Fiat-collateralized stablecoins: These hold value by backing each token issued with an equivalent value of fiat currency reserves, such as the U.S. dollar. This structure ensures a stable, trustworthy basis for these digital currencies.

Notable examples include Tether (USDT) and USD Coin (USDC), which maintain a strict one-to-one peg with the dollar. This method provides a high degree of stability relative to non-collateralized digital currencies, making them popular among users seeking dependable transactional tools and a haven from the volatility of typical cryptocurrencies.

b. Crypto-collateralized stablecoins: Unlike fiat-based counterparts, these stablecoins use other cryptocurrencies as collateral. A renowned example is DAI, backed by Ether assets locked in decentralized finance (DeFi) smart contracts.

These stablecoins maintain their peg through dynamic systems of collateral management and stabilization mechanisms, such as over-collateralization, where the value of digital assets held exceeds the value of the stablecoins issued. This strategy helps ensure stability, even with underlying fluctuations in the crypto market.

c. Algorithmic (or Non-collateralized) stablecoins: These innovative digital currencies don't rely on tangible collateral. Instead, they implement algorithms and monetary policies to manage supply, aiming to maintain a stable value. For instance, TerraUSD (UST) and Neutrino USD (USDN) adjust their supply based on changes in demand, similar to how a central bank might intervene in the fiat currency market.

This approach allows these stablecoins to remain stable without direct backing from physical or digital assets, presenting a unique model in the digital currency landscape.

d. Commodity-collateralized stablecoins: These operate under a similar principle as their fiat-collateralized counterparts, but with a crucial difference: they are backed by reserves of commodities such as gold, silver, real estate, or oil, rather than fiat currencies.

This model provides a stable basis for these cryptocurrencies by tying their value directly to tangible assets that traditionally hold value well. For example, a gold-backed stablecoin may be pegged to the value of one ounce of gold.

Notable examples within this category include Paxos Gold (PAXG), Tether Gold (XAUT), and Meld Gold by Algorand (MCAU), which are all pegged to gold, as well as Tiberius Coin, which is pegged to a basket of metals.

Globally, stablecoins have seen tremendous growth as they provide a way to bridge the gap between the stability of fiat money and the technological benefits of cryptocurrencies. As of October 2022, the total market capitalization of stablecoins exceeded $160 billion, up from just $5.5 billion in January 2018, according to Chainalysis. Stablecoins account for a significant portion of crypto trading volumes and transactions today.

However, according to CoinGecko statistics, as of January 31, 2023, the total market capitalization of stablecoins had dropped to $138.4 billion, a slight decrease due to the overall Crypto bear cycle. Despite these shifts, stablecoins maintain their essential role in bolstering stability within the digital asset space, showcasing their potential as a pivotal tool for economic stabilization in volatile markets like Nigeria's.

Stablecoin Adoption in Nigeria

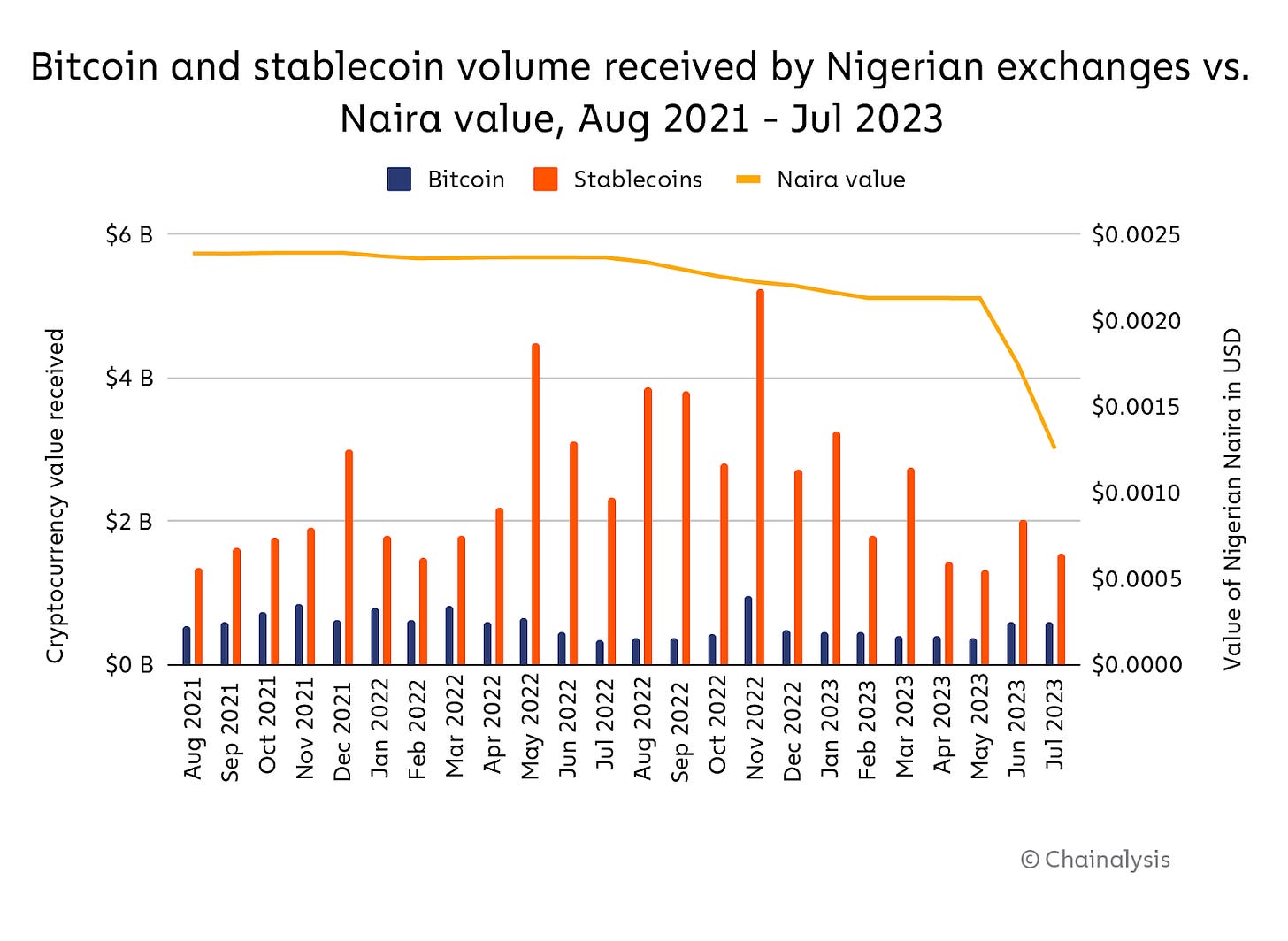

Stablecoins have seen rapid growth in adoption in Nigeria over the past few years, enabled by the country's overall early embrace of cryptocurrencies. Nigeria has emerged as one of the leading cryptocurrency markets in Africa and globally.

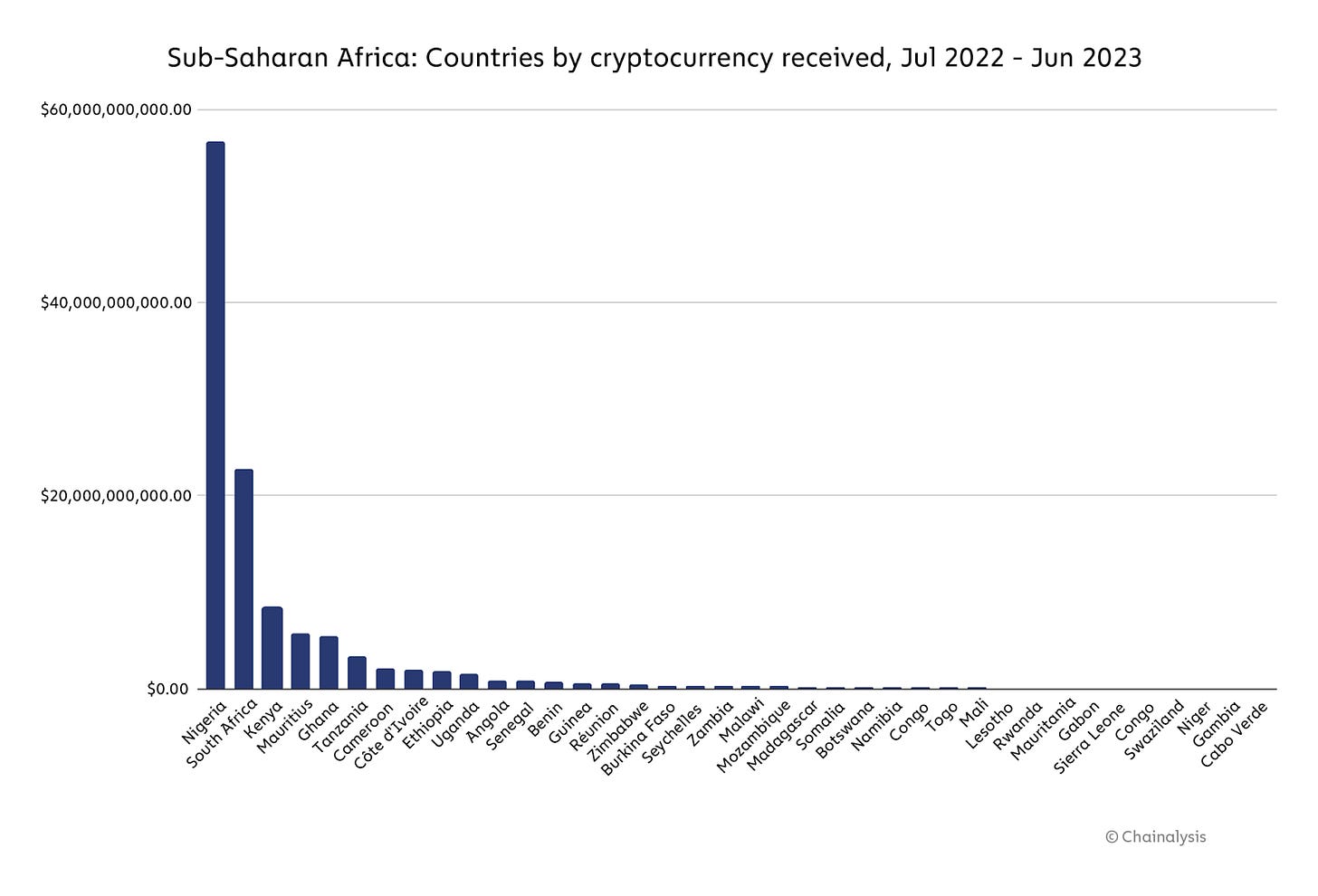

According to this report, Nigeria accounts for Africa's highest volume of cryptocurrency transactions, with over $400 million in 2020. The total value of crypto received by Nigerian addresses increased by 1,200% between July 2020 and June 2021.

Also, according to a report by Chainalysis, Nigeria accounts for the highest peer-to-peer (P2P) volume in Africa at over $300 million. The weekly P2P trading volume on LocalBitcoins and Paxful alone increased from under $5 million in January 2019 to over $30 million in December 2021, as reported by Finance Magnates.

The leading stablecoins used in the country include Tether (USDT), USD Coin (USDC), Binance USD (BUSD), DAI, and others. According to data on this blog, Tether accounts for over 70% of stablecoin transaction volume in Nigeria, given its first-mover advantage. However, the market share of USDC and BUSD has also been rising.

Drivers of Adoption

Several factors make Nigeria ripe for stablecoin adoption:

High inflation and currency devaluation. The Nigerian Naira has faced high inflation and devaluation over the years. This factor has driven demand for stable assets to preserve purchasing power. Stablecoins pegged to the US Dollar or other commodities hedge against Naira instability.

Large unbanked population: According to an EFInA report in 2023, 26% of Nigerian adults lack access to formal financial services. Stablecoins make storing and transferring value via mobile phones easier for the unbanked.

High remittance inflows: In 2023, The World Bank reported that the remittance flow in Sub-Saharan Africa is estimated to be $54 billion, and Nigeria covers 38%, amounting to $20.5 billion of the remittances in the region. Sending money across borders with cryptocurrency is often faster, cheaper, and more accessible than traditional remittance services. Nigerians abroad have turned to crypto to send money home.

Youthful tech-savvy population: Nigeria's large youth population has been incredibly receptive to cryptocurrency adoption. Over 60% of Nigeria's population is under 25 years old. Young, tech-savvy Nigerians have eagerly embraced crypto as an innovative technology with significant potential to transform financial services.

The slight openness of government policy has enabled crypto adoption: While not fully regulated, cryptocurrency is legal in Nigeria. The Central Bank has taken a measured approach, neither banning crypto nor fully regulating it yet. This regulatory flexibility has allowed innovation to flourish.

Historical Overview of Stablecoin Adoption in Nigeria

Cryptocurrency adoption first became prominent in Nigeria around 2015-2016, during the early days of the blockchain revolution. Remittances and payment use cases drove initial interest, enabled by the nationwide rise in internet connectivity and smartphone adoption. Bitcoin piqued interest among tech-savvy Nigerians as both an investment asset and a means for remittances and transactions without traditional financial institutions.

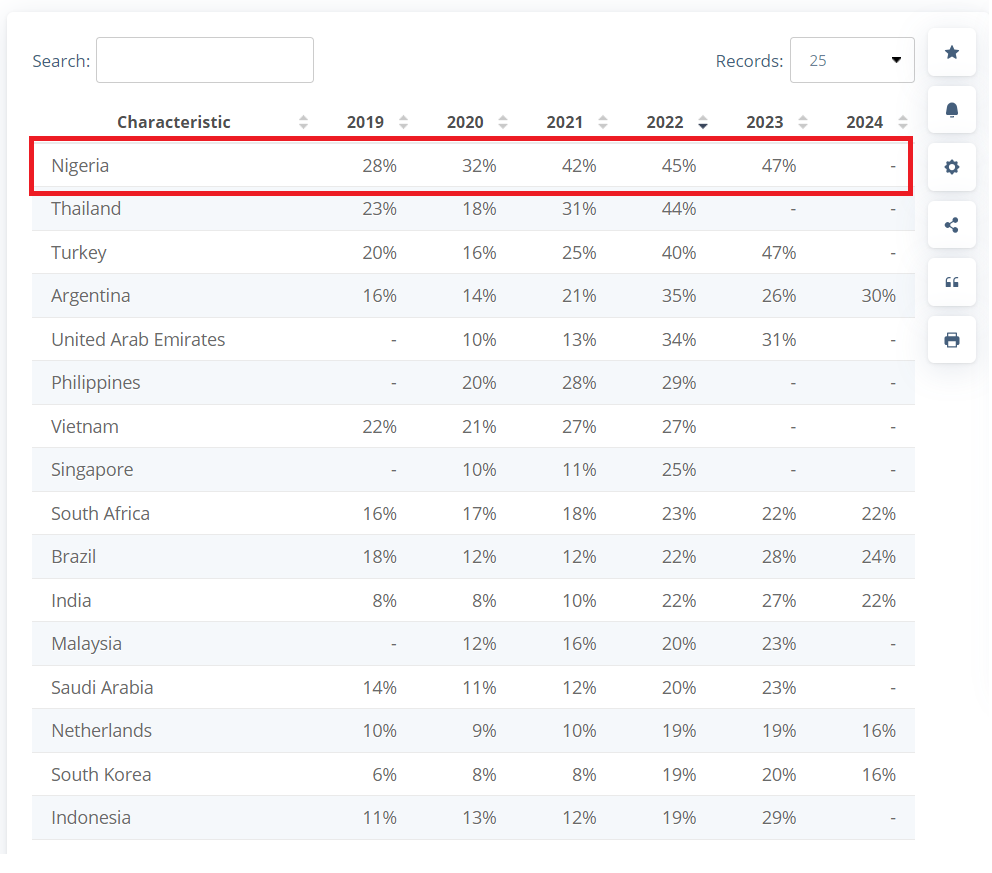

According to Statista (image above), from 2020 to 2023, Nigeria had the highest cryptocurrency adoption rate globally, with 47% of its citizens owning or using crypto in 2023, up from 28% in 2019. By 2022, crypto trading volumes in Nigeria surpassed $5 million per day, according to Chainalysis.

The Central Bank of Nigeria (CBN) first imposed restrictions in 2017, banning banks from servicing crypto exchanges. However, peer-to-peer trading continued to grow, reaching over $200 million by 2020. The CBN reiterated the ban early in 2021, leading to a boom in peer-to-peer trading volumes through decentralized exchanges.

Nigeria has adopted a more ambiguous stance, unlike some countries that explicitly ban cryptocurrency-related activities. In Nigeria, cryptocurrency companies are not outrightly prohibited, indicating a potential openness to digital currencies within the nation's borders. This ambiguous legal status has not dampened the Nigerian public's interest in cryptocurrencies. A CoinGecko study leveraging Google Trends data—including searches such as "buy crypto" and "invest in crypto"—revealed that Nigeria's interest in cryptocurrency surpasses any other African country, scoring 371 in the study.

Amidst this backdrop of growing interest and regulatory caution, the Nigerian government took a significant step forward in May 2024 by announcing a new regulatory framework. This surprising move aims to ban person-to-person Crypto trading and delist Nigerian naira from peer-to-peer cryptocurrency exchanges.

Stablecoin Use Cases

Stablecoins serve several use cases that make them attractive alternatives to traditional fiat currencies. Below are some of the most common applications for stablecoins:

a. Enhancing Remittance Efficiency

In Nigeria, stablecoins are revolutionizing cross-border transfers and remittances, offering a superior edge over traditional bank wire transfers. Services like Bitpesa and Chipper Cash are tapping into stablecoins for their ability to execute global payments instantly or almost instantly, significantly reducing transaction costs. This feature especially benefits migrant workers looking to send money back home, streamlining the remittance process.

b. Streamlining Merchant Transactions

For businesses, stablecoins simplify the transaction process, allowing for swift payment settlements without worrying about chargebacks common in traditional payment systems. Merchants can avoid the unpredictability of price fluctuations by enabling payments in stablecoins, which remain stable compared to more volatile cryptocurrencies like Bitcoin. This adoption highlights the growing global trend of merchants integrating stablecoin payments.

c. Preserving Value and Enhancing Savings

Given their inherent stability, stablecoins stand out as a reliable store of value, especially in regions plagued by high inflation rates like Nigeria. As the Naira tend to depreciate over time due to inflation, stablecoins, with their stable valuation, offer a sanctuary for individuals aiming to maintain their purchasing power and safeguard their savings against economic volatility.

d. Facilitating Lending and Borrowing

The lending and borrowing landscape is also being reshaped by stablecoins, primarily on cryptocurrency lending platforms, where they are favored for loans and interest-earning activities. Their stability makes them an attractive option for depositing to earn interest or securing loans, providing a level of assurance unattainable with fluctuating cryptocurrency assets. This stability enhances confidence among participants and meets various financial needs without traditional banking constraints.

e. Supporting Trading and Speculation Activities

For cryptocurrency traders and speculators, stablecoins are a safe harbor from market volatility. They are a strategic tool for those looking to momentarily step away from the inherent risks of the crypto market or facilitate smoother transitions between different cryptocurrencies. By enabling direct trading from fiat to crypto, stablecoins simplify the entry for newcomers into the crypto space and enhance the fluidity of trading operations on exchanges.

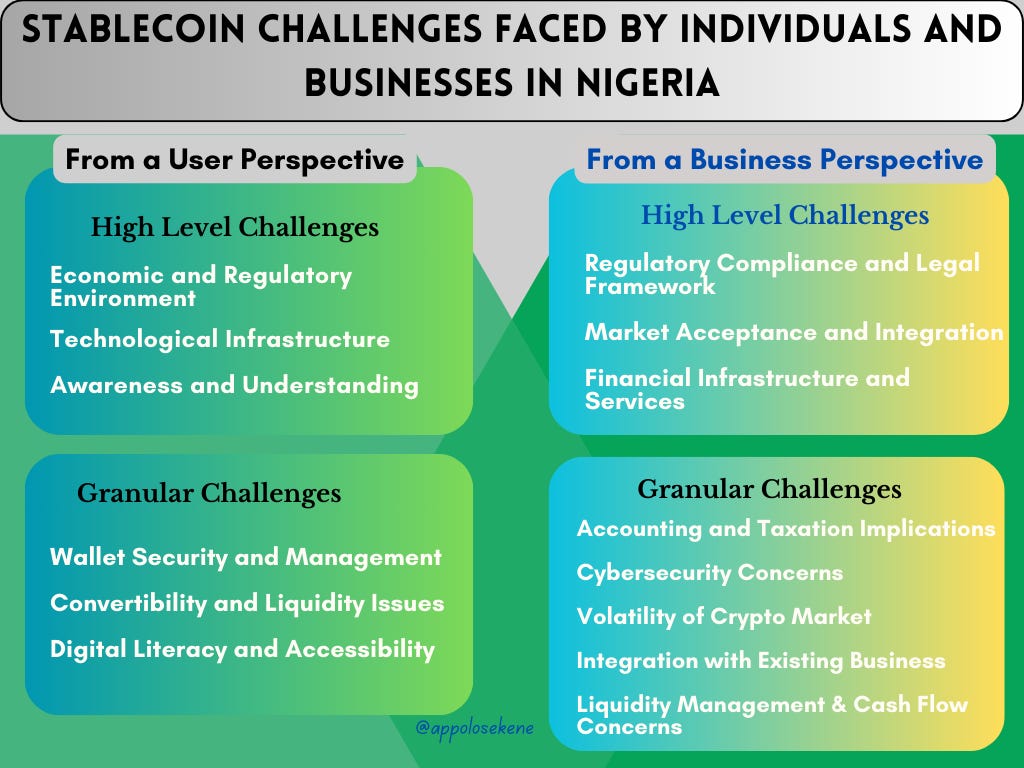

Challenges of Crypto Adoption in Nigeria

When end users, such as individuals and businesses, integrate new technologies, they often confront a spectrum of challenges. These hurdles can range from navigating technological complexities to overcoming resistance to adoption, which can significantly impact the successful utilization of the new system. This section delves into the challenges encountered and discusses strategies for effective mitigation to ensure seamless implementation and optimization of stablecoins.

Challenges From a User Perspective

High-Level Challenges

a. Economic and Regulatory Environment: At the macro level, Nigerians encounter a complex interplay of economic instability, rigorous financial regulations, and an often unclear legal stance towards cryptocurrencies, including stablecoins. These factors create an environment of uncertainty and apprehension for potential adopters.

The regulatory environment in Nigeria fosters a reliance on informal channels and peer-to-peer transactions, introducing additional layers of complexity, potential for fraud, and overall hesitancy among potential stablecoin users.

b. Technological Infrastructure: Despite significant advancements, Nigeria's technological infrastructure still presents challenges, particularly in rural areas. Issues with internet connectivity and smartphone penetration limit the accessibility and usability of stablecoin technologies for a significant portion of the population.

According to Statista, as of January 2023, 55.4% of Nigeria's population used the internet, an internet penetration rate. However, in September 2023, techcabal reported that only 40.48% of Nigerians had internet access after the Population Commission adjusted the country's population figures.

c. Awareness and Understanding: A broad lack of awareness, education, and understanding of stablecoins, their operation, and their potential benefits versus risks further hampers adoption. The concept of digital currencies, particularly those pegged to traditional assets, can be difficult for newcomers to grasp without substantial educational efforts.

Granular Challenges

a. Wallet Security and Management: The practical aspects of managing a digital wallet pose significant challenges for individuals. The fear of losing access to one's wallet due to forgotten passwords or keys or having one's holdings stolen due to security breaches can deter adoption.

Users must navigate the complexities of securely storing their private keys, understanding the differences between cold and hot storage, and choosing between various wallet providers, all of which require a level of technical knowledge that can be daunting.

b. Convertibility and Liquidity Issues: Even when users overcome initial hurdles and adopt stablecoins, they often face challenges in converting their digital assets into local currency (NGN) and vice versa. The liquidity of stablecoins, or the ease with which they can be bought and sold without affecting their price, can significantly impact their utility for everyday transactions.

This challenge is compounded by the limited number of merchants accepting stablecoins and the often convoluted processes of exchanging stablecoins for local currency, which can involve high fees, long transaction times, and reliance on peer-to-peer platforms that may present additional security risks.

c. Digital Literacy and Accessibility: The challenge of digital literacy cannot be overstated at the user level. The ability to navigate stablecoin platforms, understand market dynamics, and execute transactions safely presupposes a level of comfort with digital tools that many potential users need. Accessibility issues further compound this, especially for users in rural or under-served regions.

Challenges From a Businesses Perspective

High-Level Challenges

a. Regulatory Compliance and Legal Framework: Navigating the uncertain regulatory landscape of stablecoins in Nigeria is a paramount concern for businesses. The lack of a clear legal framework for using stablecoins and the potential for sudden policy shifts create a risky business environment. This uncertainty can affect everything from day-to-day operations to long-term strategic planning and investments.

b. Market Acceptance and Integration: Another critical challenge at the high level is achieving widespread market acceptance. For businesses, this means integrating stablecoin payment methods into their existing systems and ensuring that customers and suppliers are willing and able to engage with stablecoin transactions. This integration requires both infrastructural adjustments and a cultural shift.

c. Financial Infrastructure and Services: Businesses in Nigeria face bottlenecks due to the existing financial infrastructure, which may not be fully compatible or conducive to the adoption of stablecoins. The reliance on traditional banking services, which are regulated in a way that may conflict with the decentralized nature of stablecoins, presents operational challenges.

Granular Challenges

a. Accounting and Taxation Implications: At a granular level, businesses must contend with the accounting and taxation implications of dealing in stablecoins. Clear guidelines on how stablecoin transactions should be reported for tax purposes in Nigeria are necessary to avoid confusion and potential legal exposure, which poses a significant compliance hurdle and necessitates investment in specialized accounting expertise.

b. Cybersecurity Concerns: The risk of cyber threats and the need for robust security measures burden businesses looking to adopt stablecoins. Ensuring the security of transactions, safeguarding customer data, and protecting against fraud and theft are all critical concerns that demand considerable resources and expertise.

c. Volatility of Crypto Market Linked to Stablecoins: Despite being pegged to more stable assets, stablecoins can still be affected by the broader volatility of the cryptocurrency market. For businesses, the reputational risk associated with fluctuations in the broader crypto space, as well as the implications for the perceived stability of stablecoin holdings, can be deterrents to adoption.

d. Integration with Existing Business Operations: Integrating stablecoins into business operations can be complex, including technical integration into payment systems and accounting software and the operational shift required to accommodate a new type of currency. Substantial costs and challenges can also accompany updating or changing business processes, training staff, and adapting to a new financial ecosystem.

e. Liquidity Management and Cash Flow Concerns: As with individual users, businesses face liquidity management issues when dealing with stablecoins. The ability to quickly convert stablecoins into fiat currency or other forms of value is essential for managing cash flow and maintaining operational liquidity.

Challenges arise when there are delays in conversions, high transaction fees, or limited access to markets where stablecoins can be readily exchanged.

Opportunities for Stablecoin Projects in Nigeria

a. Microfinance and Lending

Stablecoins can dramatically improve access to microfinance and lending services in Nigeria by lowering transaction costs and enabling more efficient disbursement of funds. For example, a stablecoin-based platform could partner with local microfinance institutions to streamline the distribution of small loans, ensuring faster access to capital for entrepreneurs and small businesses, thus fostering economic growth at a grassroots level.

b. E-Government Services

Implementing stablecoins for e-government services could enhance the efficiency and transparency of public transactions. For example, the Nigerian government could pilot a project where citizens pay for public services, like utilities or taxes, using a stablecoin to reduce leakage, improve collection rates, and provide a transparent ledger of transactions.

c. Cross-Border Trade Facilitation

Stablecoins can simplify cross-border trade by offering real-time, currency-agnostic settlement options. Example: A Nigeria-based exporter could instantly use stablecoins to receive payments from international buyers, eliminating the need for costly and time-consuming bank transfers and mitigating currency fluctuation risks. In another example, a stablecoin project could partner with remittance service providers to facilitate seamless cross-border transfers

d. Retail Integration

Integrating stablecoins into the retail sector for daily transactions can reduce reliance on cash and improve digital traceability. For example, a partnership between stablecoin projects and a Nigerian retail chain could allow customers to pay for goods using stablecoins through mobile apps, enhancing convenience and encouraging the adoption of digital currencies for everyday purchases.

e. Financial Inclusion

Stablecoins can contribute to financial inclusion by providing a stable digital currency to the unbanked population. By partnering with local businesses and mobile money operators, stablecoin projects can reach out to those without access to traditional banking services. For example, a stablecoin project could collaborate with local telecom companies to offer mobile money services.

f. E-commerce and Online Payments

Nigeria's e-commerce sector is growing rapidly. Stablecoins can provide a secure and efficient means of payment for online transactions. By integrating with popular e-commerce platforms, stablecoin projects can facilitate smoother online transactions. An example could be a partnership between a stablecoin project and a central online marketplace in Nigeria.

Role of Government Policy

Government policy has a significant role in enabling stablecoin adoption while managing risks. Key areas of focus include:

Regulations on stablecoin issuers: Governments are developing frameworks to regulate entities that issue stablecoins, including reserve requirements, auditing, and transparency. These measures aim to ensure stability and reduce systemic risks.

Tax treatment: Clarifying the tax treatment of stablecoins provides certainty to users and projects. Some jurisdictions treat stablecoins as currency, while others view them as property or securities.

Promoting innovation and competition: Governments want to balance enabling innovation in stablecoins while managing risks. Regulatory sandboxes allow controlled testing of new models.

Consumer protections: As stablecoins see wider adoption, regulations are needed to protect consumers from risks like fraud, theft, and loss of funds. Disclosure requirements, custody rules, and complaint mechanisms can help.

Enhancing Stablecoin Adoption in Nigeria

Stablecoins hold tremendous potential for improving Nigeria's financial inclusion and stability. However, realizing this potential requires concerted efforts to address existing barriers and promote broader adoption. Targeted initiatives in education, regulation, collaboration, and applied learning from global case studies can pave the way for stablecoins to flourish.

a. Improving Digital Literacy

One significant barrier to crypto adoption is low levels of digital literacy and a lack of understanding of blockchain and cryptocurrencies. Educational initiatives can play an essential role in improving digital literacy and awareness. The government, non-profits, and blockchain companies can collaborate to launch digital literacy programs, workshops, conferences, and meetups to educate people on the basics of cryptocurrencies and blockchain technology.

Mass media campaigns on radio, TV, and social media can also help spread awareness. 'Train the trainer' programs can equip local leaders to educate their communities. All these efforts would help dispel misconceptions and build more openness towards crypto adoption.

b. Regulatory Clarity

More explicit cryptocurrency regulations would provide more legitimacy and certainty for users and businesses to adopt crypto. The Nigerian government can work with the blockchain industry to develop appropriate rules, including officially classifying and recognizing cryptocurrencies, defining compliance requirements, establishing consumer protection safeguards, and creating dispute resolution mechanisms. With prudent regulations, businesses and consumers would have greater confidence in adopting cryptocurrencies. However, heavy-handed regulations that stifle innovation should be avoided.

The IMF recommends a proportionate approach suitable for Nigeria's context. Ongoing dialogue between policymakers, crypto companies, and users will be necessary.

c. Partnerships and Innovation

Collaborations between financial institutions, tech companies, and the government can drive stablecoin adoption. Banks can partner with crypto exchanges on services. Startups can innovate through user-friendly interfaces. Such partnerships should be encouraged through supportive policies and sandbox mechanisms.

d. Developing Use Cases

Driving adoption requires developing locally relevant use cases that fulfill people's needs. Some potential use cases include enabling fast and inexpensive remittances, facilitating trade, building decentralized finance apps for lending and borrowing, accepting stablecoin donations for non-profits, and using stablecoins to preserve savings against inflation.

By building platforms and apps tailored to these use cases, crypto can demonstrate meaningful utility for Nigerians. User-friendly interfaces in local languages can further drive adoption.

Case Studies: Successful Stablecoin Adoption Around the World

Several countries have adopted stablecoins as payment, store of value, and unit of account. Here are some case studies of countries that have successfully adopted stablecoins:

Singapore

The Monetary Authority of Singapore (MAS) finalized its regulatory framework for stablecoins in late 2023. The new framework applies to single-currency stablecoins (SCS) pegged to the Singapore Dollar or any G10 currency issued in Singapore. Issuers of such stablecoins must fulfil critical value stability, capital, redemption at par, and disclosure requirements.

Switzerland

In the context of stablecoin adoption, Switzerland has made significant strides in exploring the potential of digital currencies. The Swiss National Bank (SNB) and the Bank for International Settlements (BIS) have collaborated on a project involving digital currencies. This project is called Project Jura; it involved an experiment using wholesale Central Bank Digital Currency (wCBDC) for cross-border settlement. The experiment involved the exchange of a euro wCBDC against a Swiss franc wCBDC through a payment versus payment (PvP) settlement mechanism. This experiment highlights the potential of digital currencies, including stablecoins, in facilitating efficient cross-border transactions.

United States

In the United States, stablecoins have been gaining popularity. They are primarily used to facilitate trading, lending, or borrowing of other digital assets, predominantly on or through digital asset trading platforms.

Transactions involving USD-backed stablecoins reached nearly $6.87 trillion in 2022, surpassing the volumes of Mastercard and PayPal. The popularity of United States dollar-denominated stablecoins in decentralized finance (DeFi) may be helping secure the dollar’s dominance as a global reserve currency.

Currently, stablecoins are not regulated meaningfully in the United States. However, there have been discussions and proposals around regulating them:

Members of the House of Representatives introduced the Stablecoin Tethering and Bank Licensing Enforcement (STABLE) Act on November 30, 2020. This act would require stablecoin issuers to have a banking charter, be FDIC-insured, and maintain adequate reserves.

Securities and Exchange Commission Chairman Gary Gensler has hinted that stablecoins like PAX and BUSD could be subject to securities laws.

El Salvador

El Salvador, a Central American nation, made history by becoming the first country to adopt Bitcoin as legal tender. President Nayib Bukele spearheaded this move to promote financial inclusion, investment, and economic development.

The Legislative Assembly of El Salvador passed the Bitcoin Law on June 9, 2021. The law mandates that all economic agents accept Bitcoin as payment unless they lack the necessary technology. The market sets the Bitcoin/Dollar exchange rate.

Marshall Islands

The Republic of the Marshall Islands, a Pacific island nation, adopted a digital currency, the Sovereign (SOV), as its official currency. The SOV, developed in partnership with Neema, a fintech startup, is a decentralized cryptocurrency that operates alongside the USD. Unlike stablecoins, the SOV isn’t pegged to any fiat currency. The specifics of its use in government services are yet to be disclosed. The SOV project underscores the potential and challenges of nation-states adopting digital currencies.

cNGN: Stablecoin Backed By Naira

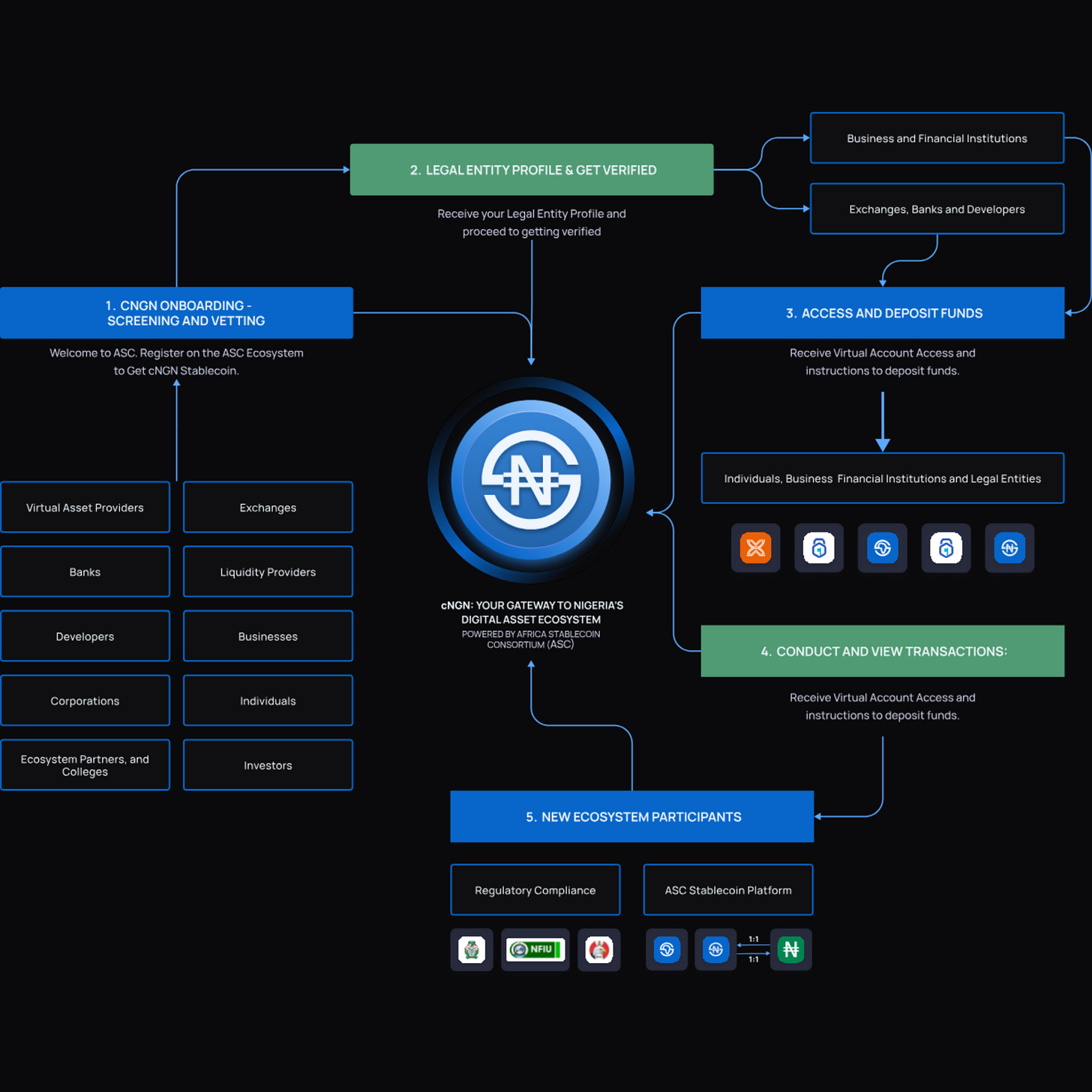

Nigeria is making significant strides by introducing the Compliant Naira Stablecoin (cNGN) in the rapidly evolving world of stablecoins and digital currencies. This innovative digital currency initiative is set to revolutionize the financial ecosystem in Nigeria and beyond.

The cNGN is a consortium-driven stablecoin, pegged 1:1 to the Naira and backed by Naira reserves held in designated commercial banks. This ensures that the cNGN's value remains stable, providing a secure and efficient medium of exchange for users.

The Central Bank of Nigeria (CBN) has officially approved the cNGN. This approval paves the way for the Africa Stablecoin Consortium (ASC), a collaboration of Nigerian banks and fintech companies, to launch the new stablecoin. Although the approval has been given, due to ongoing regulatory compliance verifications, the launch hasn’t happened yet

One of the key advantages of the cNGN is its potential to facilitate remittances and cross-border payments. Given Nigeria's large diaspora population and the volume of remittances, the cNGN can provide a faster and more cost-effective solution.

Moreover, the cNGN can contribute to financial inclusion by providing a stable digital currency to the unbanked population. By partnering with local businesses and mobile money operators, the cNGN can reach out to those without access to traditional banking services.

Furthermore, the cNGN is set to coexist with the eNaira, Nigeria’s central bank digital currency (CBDC). However, differing opinions exist on how these two digital assets will interact. They are both digital currencies in Nigeria. The cNGN is a consortium-driven stablecoin backed by Naira reserves and approved by the Central Bank of Nigeria (CBN). The eNaira is a Central Bank Digital Currency (CBDC) owned and managed by the CBN. While both aim to enhance financial inclusion and stability, they differ in ownership, management, limits, liabilities, and their centralization vs decentralization approach.

The introduction of the cNGN comes at a time when the adoption of blockchain and Web3 technologies is gaining momentum in Africa. As such, the cNGN is not just a stablecoin but a testament to Nigeria’s commitment to embracing the future of finance.

Features of cNGN

Some of the Features of cNGN, as outlined by the ASC, are as follows:

Stability: cNGN tokens are assets pegged 1:1 with the Nigerian Naira and backed 100% by ASC’s reserves, which enables the value of cNGN to remain stable, providing a secure and efficient medium of exchange.

Regulatory Compliance: The cNGN has met all regulatory standards set by the Central Bank of Nigeria (CBN), the Nigerian Securities and Exchange Commission (SEC), and the Nigerian Financial Intelligence Unit (NFIU).

Interoperability: Like its well-established counterparts, the cNGN offers seamless interoperability across a spectrum of public blockchains. This robust feature facilitates frictionless global transfers, enhancing its utility and extending its reach internationally.

Financial Inclusion: cNGN enables Nigerians without access to traditional banking infrastructure to store value, make payments, and access financial services through blockchain-based platforms.

Transparency: All cNGN in circulation is fully backed 1:1 with Nigerian Naira reserves, held in designated commercial banks1. The mechanism ensures transparency and publishes a daily record of assets and reserves.

Partnerships: This visionary initiative boasts an impressive lineup of influential partners, spearheading the cNGN’s development2. Noteworthy collaborators include Access Bank, Sterling Bank, Providus, Korapay, First Bank, Interstellar, Interswitch, Budpay, and Convexity.

Conclusion

Recap of the Stablecoin Potentials and Challenges

Stablecoins have seen rapid growth in adoption in Nigeria over the past few years, driven by several use cases. Nigerians have embraced stablecoins as a faster, cheaper option for remittances and cross-border payments. Merchants are also starting to accept stablecoin payments to avoid the volatility of the naira.

For many unbanked Nigerians, stablecoins provide an opportunity to participate in financial services for the first time. Stablecoins enable savings, lending, investments, and other financial tools without a bank account. The decentralized nature of stablecoins also appeals in a country where trust in banks and government is low.

However, stablecoin adoption in Nigeria still faces some challenges. Regulators are still assessing how best to regulate these new assets and protect consumers. Risks around security, privacy, and price stability need to be monitored. Technical barriers like internet connectivity and digital literacy also affect adoption.

Future Outlook

Looking ahead, I expect stablecoin use to continue growing as more Nigerians become aware of the benefits. Key players like exchanges and wallets should focus on improving UI/UX, adding educational resources, and meeting compliance requirements as the space formalizes. Policymakers need to take a balanced approach, protecting consumers while encouraging innovation.

If the major obstacles can be overcome, stablecoins could empower many unbanked and underbanked Nigerians. Remittances and savings can be cheaper, faster, and more reliable. Businesses can use stablecoins to tap into global commerce. Nigeria's youthful population is already embracing crypto - with thoughtful governance, stablecoins could provide key financial services for the next generation.

With all these structures in place, Nigeria could become a leading hub for stablecoin innovation. Realizing this future would bring immense economic benefits like job creation, financial inclusion, and GDP growth. Nigeria has the chance to leapfrog traditional finance, much like it did with mobile payments. But it requires proactive engagement between crypto startups, regulators, telecoms, and financial incumbents to realize a shared vision.

Final Thought

The time is now for Nigeria to embrace stablecoins' potential. With thoughtful regulations, investment in digital infrastructure, and public-private partnerships, stablecoins could profoundly transform finance and economic development. There will be challenges along the way, but the opportunities far outweigh the risks. Nigeria's young, tech-savvy population is ready to be at the forefront of stablecoin adoption - the rest of the country should follow their lead.

There is much work to be done. The government can provide clear regulatory guidance. Businesses can integrate stablecoin payments and services. Developers can create solutions tailored to local needs. And individuals can advocate for policies that protect consumers while supporting innovation. This shared effort can unlock the full potential of stablecoins in Nigeria.

References

Nigerian Naira Crashes After Government Removes Peg (Business Insider)

Nigeria's Currency Crisis is Decades in the Making (The Economist)

Nigeria's Currency Crisis is Decades in the Making (The Economist)

Stablecoins Boost US Dollar as Global Reserve Currency: Fed Governor (CoinTelegraph)

El Salvador Proposes Law to Make Bitcoin Legal Tender (CNBC)

Marshall Islands Envisions National Digital Currency (Yahoo Finance)

Top 15 Countries Most Curious about Cryptocurrency (CoinGecko Research)

Global Cryptocurrency Regulations Changing (World Economic Forum)

Clash of Streamers: How to Increase Crypto Adoption (Publish0x)

MAS Finalizes Stablecoin Regulatory Framework (Monetary Authority of Singapore)

Stablecoins Popularity Bolsters U.S. Dollar's Dominance in DeFi: Fed Governor (MSN Money)